Solutions

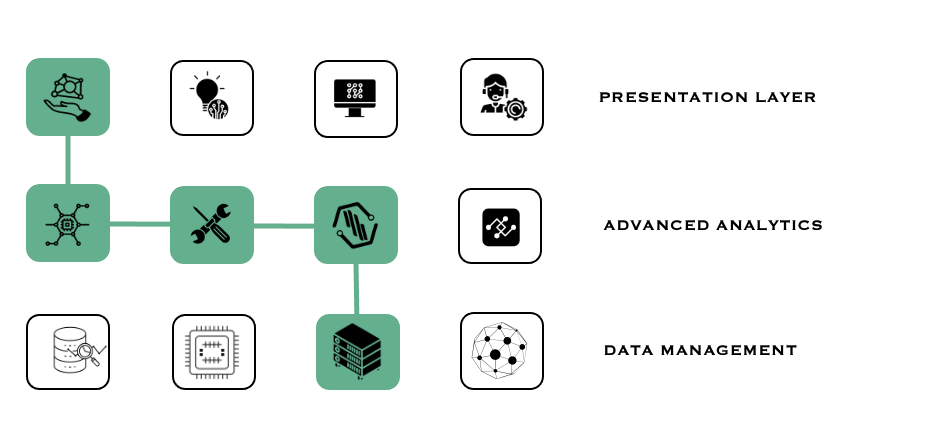

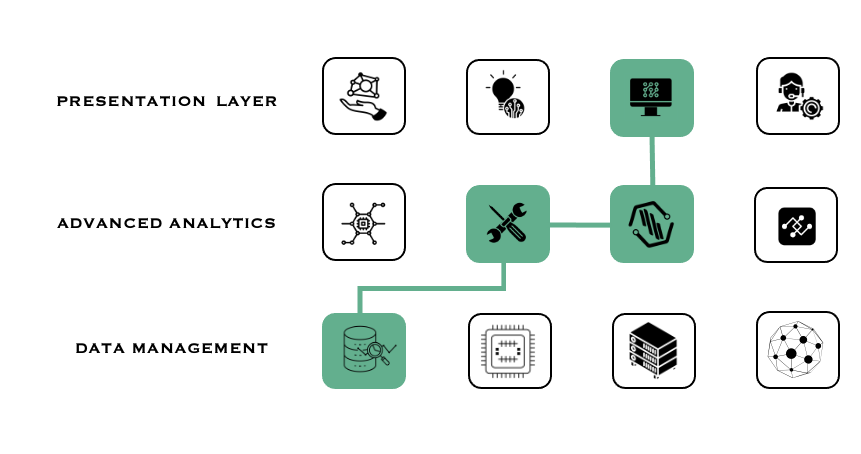

Our technology platform, specifically focused on risk management, allows fast, plug and play of data-driven applications. It is an open source and highly-customizable solution. Our modular architecture gives us flexibility and wide product choices with unbeatable money to value. Whether you want us to run a single process or an end-to-end digital service, we can do it fast and around your existing tech.

Riskwapps beautifully engineered to work well together!

P2P Lenders

Peer-to-peer lending is also known as “social lending” and it is the practice of matching borrowers and lenders through online platforms. During the last decade we have seen the flourishing of numerous peer-to-peer platforms, which are now part of the financial ecosystem. Borrowers are usually able to obtain funds quickly and typically at lower interest rates than traditional financial intermediaries. Peer-to-peer platforms don’t lend their own money, instead they match potential borrowers (individuals or small businesses) with a pool of lenders who buy notes or securities issued by the platform.

- Improve and automate the risk assessment process in order to deliver high value to customer

- Risk reporting and performance analytics

- Build, back-test and deploy credit risk models faster

- Make better lending decisions using a broad range of scoring methodologies to assess risk exposure

- Deploy scenario-based risk analytics to simulate risk exposure and support capital planning

Data Enrichment Platform

The Data Enrichment Platform is a comprehensive solution to handle the challenges of distributed and increasing data volumes, inconsistently defined data across different IT systems. Data consumers expect the data to be correct, complete and available when they need it. It consolidates data from internal and external sources, tracks data lineage, and reduces errors and inconsistencies with embedded data quality tools.

- Access virtually all data sources

- Extract, cleanse, transform, conform, aggregate, load and manage data

- Data warehousing facilitates the implementation of long-term strategies and gives access to the company information

- Apply Data Quality Policy using industrialized, standardized and predefined business rules based on regulatory requirements

- Test and validation new transactional data

- Data governance

It enables organizations to efficiently manage simple to complex data integration projects in a timely, cost-effective manner and to meet the needs of information consumers. Our solution is a perfect suit when flexibility and openness are required to take advantage of the potential of new technologies and methods with unbeatable money to value.

Data Enrichment Platform

The Data Enrichment Platform is a comprehensive solution to handle the challenges of distributed and increasing data volumes, inconsistently defined data across different IT systems. Data consumers expect the data to be correct, complete and available when they need it. It consolidates data from internal and external sources, tracks data lineage, and reduces errors and inconsistencies with embedded data quality tools.

- Access virtually all data sources

- Extract, cleanse, transform, conform, aggregate, load and manage data

- Data warehousing facilitates the implementation of long-term strategies and gives access to the company information

- Apply Data Quality Policy using industrialized, standardized and predefined business rules based on regulatory requirements

- Test and validation new transactional data

- Data governance

It enables organizations to efficiently manage simple to complex data integration projects in a timely, cost-effective manner and to meet the needs of information consumers. Our solution is a perfect suit when flexibility and openness are required to take advantage of the potential of new technologies and methods with unbeatable money to value.

SME Credit Risk Platform

Credit risk management, especially in more complex institutions is a very laborious and tedious endeavour; it requires armies professionals in IT, statistics, compliance, regulation, business processes and much more to come up with sensible credit risk models suitable for the day-to-day business and regulatory requirements.

In fact, the problem is not that there are too many people and too much complexity in the credit risk frameworks for lenders, but rather that the models and processes are often lacking nuance and subtlety. With the rise of AI and big data, there is much room to leverage newly available data and technologies to make credit risk models more predictive, this however entails the presence of extraordinary IT infrastructures and, most importantly, huge amounts of data. Our solution is applicable to many credit risk aspects, including lending decisioning, portfolio monitoring, early warning systems, default alerts, recovery process monitoring, provisioning, stress testing, capital calculation, pricing and much more. Smaller institutions can now afford to have periodic reporting on the status of their credit portfolios and stay on top of their credit risk exposure.

SME Credit Risk Platform

Credit risk management, especially in more complex institutions is a very laborious and tedious endeavour; it requires armies professionals in IT, statistics, compliance, regulation, business processes and much more to come up with sensible credit risk models suitable for the day-to-day business and regulatory requirements.

In fact, the problem is not that there are too many people and too much complexity in the credit risk frameworks for lenders, but rather that the models and processes are often lacking nuance and subtlety. With the rise of AI and big data, there is much room to leverage newly available data and technologies to make credit risk models more predictive, this however entails the presence of extraordinary IT infrastructures and, most importantly, huge amounts of data. Our solution is applicable to many credit risk aspects, including lending decisioning, portfolio monitoring, early warning systems, default alerts, recovery process monitoring, provisioning, stress testing, capital calculation, pricing and much more. Smaller institutions can now afford to have periodic reporting on the status of their credit portfolios and stay on top of their credit risk exposure.